https://pixabay.com/en/analytics-google-data-visits-page-3680198/Paste

The use of big data and data from the internet of things (IoT) is changing business so rapidly it is hard to predict what is next, and financial analytics are certainly no exception. While the need for financial analysts continues to rise, the way analysts performs their day-to-day functions is evolving.

More data than ever before is put into the evaluation of company financials, market analysis, and investment predictions. A company’s decision to issue bonds, split stock, or even initiate stock buyback options is much more informed than ever before.

So where is data and financial analytics taking us in 2019? Here is a closer look:

Advanced Analytics and Data Science

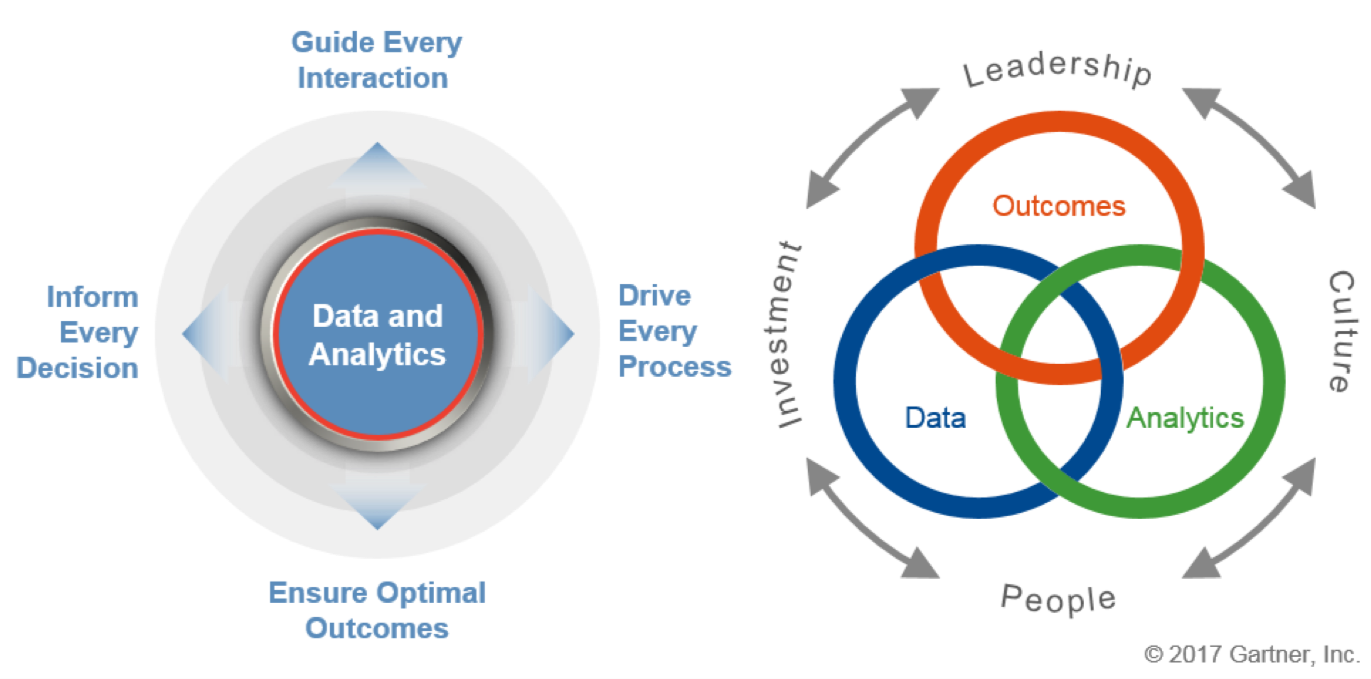

Data and analytics are more pervasive than ever in nearly every enterprise. They are increasingly the key to nearly every process a business engages in. These statistics tell the story best:

- Deep neural networks or deep learning is in 80 percent of data scientists’ toolboxes.

- By 2020 more than 40 percent of data science tasks will be automated.

- Nearly 50 percent of analytics queries are done via natural language queries (voice) or are auto-generated.

In large part, this is due to wider adoption of artificial intelligence options. What this means for business and the future of analytics is simply this: by the end of 2019, 10 percent of IT hires will be writing scripts for bot interactions.

In fact, according to the McKinsey Global Institute, despite the growth of both data and the use of artificial intelligence to analyze it, most companies are “only capturing a fraction of their potential value in terms of revenue and profit gains.”

Their weaknesses, ones that can be solved with proper data and analytics, are many. Here are a few:

- Inefficient matching of supply and demand. Many companies are not taking advantage of analytics that can predict with amazing accuracy seasonal demand and annual lulls.

- Prevalence of underutilized assets. Many businesses have assets that sit idle or employees and departments duplicating tasks, something easily determined by honest analytics.

- Dependence on demographic data rather than more efficient behavioral data. Behavioral data says a lot more about both clients and employees, and is much easier to use.

Over the next year, more companies will become dependent on analytics, and those companies who do not adapt will be three times more likely to fail.

The Blockchain, Predictive Analytics, and Security

What role does the blockchain play in all of this? The key is this: the blockchain security system is based on a shared ledger, a much more transparent way of saving data. Predictive analytics — essentially the ability to predict the future with some accuracy — requires a lot of data and until recently, a lot of specialized training.

This is because data scientists are a new breed and help determine what data is appropriate for the predictive model. The more data produced, the more accurate the prediction. Thousands or sometimes even millions of points of data are needed. This data analytics is directly related to real-time decision making, and predictive analytics leads to goal setting and future business planning. These are all things business analysts learn through coursework and on-the-job training and understanding.

Blockchain, because of the shared computing power it uses, can use natural language processing to determine the defining boundaries of the data to be analyzed. As mentioned above, more natural language queries than ever before will be posed, and blockchain has the ability to bring the power of artificial intelligence to even the smallest of businesses.

Along with this power comes the security of blockchain and the stability of the data created (a complex discussion in and of itself).

Multiple Expansion and a Bullish Market

https://www.cnbc.com/2018/09/04/credit-suisse-releases-bullish-2019-stock-market-target.html

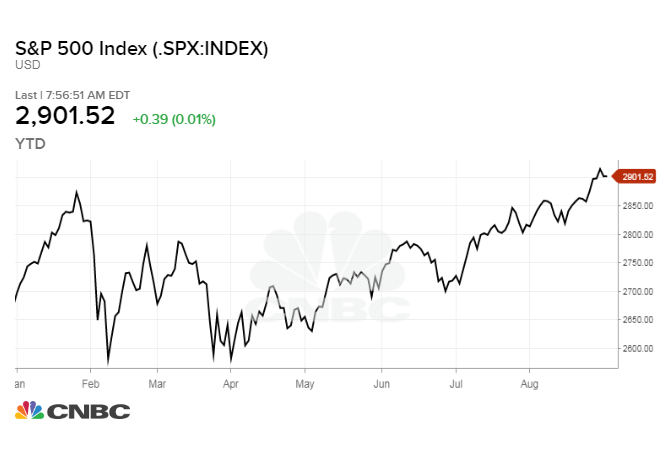

From this financial analysis, Credit Suisse has given us our first financial predictions for 2019: it is going to be a bullish year, with annual gains of around 11.4 percent. That could mean that the Fed’s recent decisions to raise rates could be right on.

Why? Because according to artificial intelligence, the next recession in the U.S. is expected to begin in 2019 according to the San Diego based company Intensity. What is this artificial intelligence method, and how does it compare to its human counterparts?

The company’s forecasting “engine” relies on continual model updating, much like data scientists depend on analyzing the latest data. In fact, the company is comprised of data scientists, statisticians, and PhDs.

The engine takes real-time data and feeds it into several different models, which it combines to make predictions that vary with real-time conditions. You can look at the latest prediction here, which says that a recession is 82 percent likely in the next 12 months and sets the likelihood over 50 percent in March of 2019.

As 2019 approaches, this kind of data, fed into artificial intelligence and deep learning models, will impact how more companies than ever do business. While we can’t take the human factor out of the equation, it seems we are becoming more and more predictable — or the machines are just getting better at it. But as always, predictions, even those with supporting data, can be wrong. All we can do ist work with the data and have an advantage on the predictions being right.