Most Bitcoin articles get rushed up in the price movements of Bitcoin, and there's a place for that. This article, instead, will focus on the technical and InfoSec aspects of Bitcoin, and will aim to provide an understanding of the Bitcoin network and protocol.

Bitcoin has been spoken of repeatedly in the news, nearly always on the topic of price movements and where it may go next. For more technical readers, the price movements aren't always the most important point. You may have fundamental questions that remain unanswered by these news organizations. Questions like; "How many Bitcoins are there?", "What is the Bitcoin network?", and even "How can I participate?"

What is the purpose of Bitcoin?

Firstly, what is the purpose of Bitcoin? Why does it exist? In the words of Satoshi Nakamoto, the anonymous inventor of Bitcoin:

“Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments. While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust based model. Completely non-reversible transactions are not really possible, since financial institutions cannot avoid mediating disputes. The cost of mediation increases transaction costs, limiting the minimum practical transaction size and cutting off the possibility for small casual transactions, and there is a broader cost in the loss of ability to make non-reversible payments for non-reversible services. With the possibility of reversal, the need for trust spreads. Merchants must be wary of their customers, hassling them for more information than they would otherwise need. A certain percentage of fraud is accepted as unavoidable. These costs and payment uncertainties can be avoided in person by using physical currency, but no mechanism exists to make payments over a communications channel without a trusted party. What is needed is an electronic payment system based on cryptographic proof instead of trust...”

I like to say that each new person in Bitcoin adds a new use case. Some people believe Bitcoin is less of a new technology, and more of a paradigm shift. This paradigm shift will continue to grow, fueled from the global development underway, but ultimately, the fundamental goal is to transmit the properties of cash onto the Internet. This enables censorship resistance, irrevocability, fast confirmation, and pseudonymity, while setting the way for Internet-bound asset classes.

Think of a Bitcoin as a unit of currency. There are a few characteristics that we need to address when thinking about currency. Some important characteristics are total supply, divisibility, and deflation. When it comes to Bitcoin, there will never be more than twenty-one million Bitcoins. Presently there are around 16.5 million Bitcoins, and this will slowly rise until there are twenty-one million. This is due to the process known as "the halving", which essentially means the reward for mining a block is divided in half. This creates an algorithmic decline, until all Bitcoins have been mined. Once there is no longer a mining reward (coinbase), miners will only profit from fees included in transactions. This means Bitcoin is deflationary, or that its supply slowly reduces. If twenty-one million Bitcoins seems like a small number, don't worry. A Bitcoin can be divided down to the eighth decimal, the smallest unit being a 'satoshi'.

These Bitcoins are, ultimately, just private keys. Cryptography is the blood and veins of the Bitcoin protocol (like many protocols), and this allows us to interact with our money from a purely digital standpoint. The entire foundation of Bitcoin possession is built upon secure private key generation, storage, and handling. Private keys are usually 256 binary digits, which can be displayed as 64 hexadecimal digits. Private keys are secure from brute force attacks because of the sheer number of possible keys. There are approximately 10^77 possible private keys, and for perspective, there are estimated to be 10^80 atoms in the observable universe. The goal is to have all the cryptography done behind the scenes (much like web browsing), but it can be helpful to understand exactly what is happening when you are interacting with your keys.

When your wallet generates a private key (used for spending your Bitcoin), it can also use elliptic curve multiplication to create a public key. Public key cryptography has been practiced since the 1970s, and is a mathematical foundation for information security. Its basis is on practically irreversible math functions. In plain English, this allows our public keys to receive Bitcoin without exposing our private keys. Here's a video on how a wallet works:

Explain how Bitcoins play a role in the economy

Cash has unique capabilities compared to digital bank systems. When using digital banking systems such as debit or credit, it can take up to 180 days for transactions to become irreversible. With cash, the moment you hand your dollar bill to someone, they know it is in their possession permanently. This is not true with credit cards, or even PayPal. For these types of transactions, trust is required that the sender will not revoke the payment remotely. Bitcoin aims to fix this.

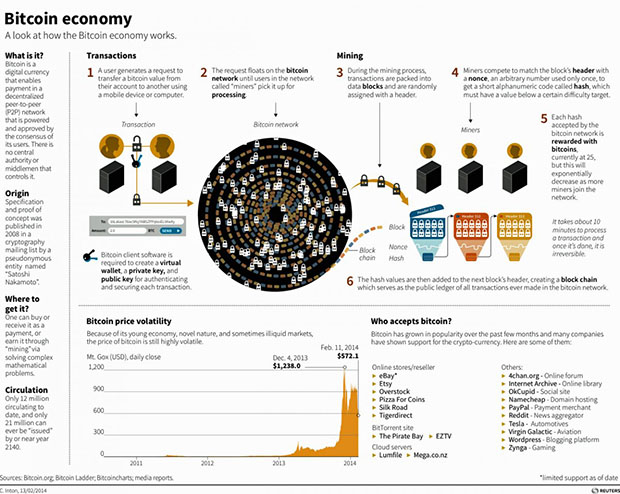

I will explain the process that occurs when you spend Bitcoin, and then I will go deeper into the technical components. The journey of a Bitcoin transaction starts when it arrives at a node. This node is connected to thousands of other nodes. If your transaction is compatible with the rules of that node, it will propagate it to neighboring nodes. If your transaction does not follow the rules of a node, it is dropped. This repeats indefinitely until the whole network is aware of the transaction.

This propagation happens as quickly as a credit card purchase. Once the network of nodes (or even a portion) is aware of the transaction, miners start working to confirm it. Depending on priority factors, miners will "confirm" your transaction within a couple of blocks. When your transaction is confirmed by a miner, your transaction is now in the blockchain and can be independently verified that it is irreversible - anywhere with Internet access. Your transaction will be confirmed indefinitely every ~10 minutes, each time gaining one confirmation. The more confirmations, the more resources it would take to cheat the system. It quickly becomes too expensive to execute attacks (reversals) on Bitcoin transactions.

With how valuable the Bitcoin network is, there need to be strong measures to defend its integrity. The Bitcoin network utilizes many factors to keep running reliably; factors such as economic incentive, game theory, cryptography, and decentralized components come together to create what some call a paradigm shift. However, because of the decentralized nature of Bitcoin, communal changes or shifts in perception can lead to confusing outcomes.

Educational picture from MarketCalls

Emergent consensus is the process that occurs when the Bitcoin network undergoes changes to the protocol. Because there is no central entity to coordinate everything, the results can be messy. Bitcoin Cash ($BCH) is a fork of the Bitcoin blockchain, that now operates on different, incompatible rules. This means that BCH shares the same history of Bitcoin's blockchain, but now, BCH's blockchain can utilize 8MB blocks, along with some other changes that aren't needed in this article. BTC and BCH are now two separate cryptocurrencies, even though they share the same history. This was a confusing and disruptive event for many. It remains to be a nuisance to those who oppose it, however it is clear that ultimately Bitcoin as a protocol isn't threatened by its existence.

Thank you for reading. This is only a small cornerstone of the moving parts of Bitcoin, and I hope your interest is piqued. If you are interested in further research, I have linked helpful resources on Bitcoin education. Please feel free to contact me if you have questions or concerns.